April 13, 2020

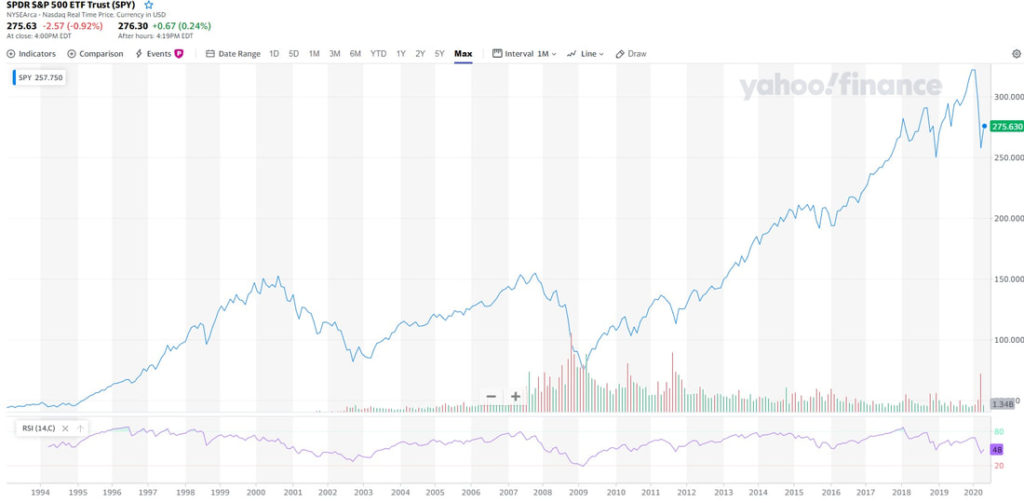

Did the bottom happen?

A key question that investors are asking is will the low of the current market cycle be 2,187?

There are certainly a lot of unknowns as the first quarter earning season is in full swing.

Today’s cable channel news programs provided excellent summaries of a range of investment house calls on the direction of the market.

Valuing the S&P 500?

150 x 17 = 2,550

$SPY closed at 275.63, April 13, 2020

Many market strategists & equity research analysts look to past market dislocations for patterns. On Mad Money, Jim Cramer provided an excellent summary of several previous bear markets all of which failed to retest the bottom once 50% of the drawdown had been retraced. Of course, looking to past might not be as relevant in this instance because of the uniqueness of the COVID-2019 situation.

1962 DJIA Bear Market

1970 DJIA Bear Market

2008-2009 DJIA Bear Market

2020 S&P 500 Bear Market

Image sources via CNBC