August 17, 2020

In April 1993, Newsweek wrote about IBM’s decision to hire an outsider as its next CEO. The new CEO had neither IBM

specific nor industry expertise. The article indicates that other “successful” CEOs weren’t interested in the position and hence the IBM board was forced into hiring a sub-optimal candidate.

Now, some two-and-half decades later, it’s interesting to look back at the situation, strategic decisions and results.

The Situation in 1993

For the nation’s fourth biggest company, times had never been tougher. Despite cutting 100,000 jobs in three years, closing plants and abandoning a cherished commitment to lifetime employment, IBM lost $5 billion in 1992, and the computer industry’s brutal price wars make more red ink likely this year.

The core of the its problem was IBM “badly misjudged the direction of computing in the 1980s. It continued to focus on mainframe computers even as customers were replacing them with networks of desktop units. It didn’t foresee that low-cost clones would steal away its lead in personal computers, and it was slow to understand that much of the profit in computing would move from hardware to chips and software. And, while competitors dramatically reshaped themselves, IBM dithered.

Strategic Decisions

The firm did take some action in 1991 such as:

However, by early 1993, the company’s directors quickly decided that no insider would be able to pull the company out of its tailspin. “IBM’s No. 1 problem is to change the internal culture,” says an IBM insider.

The Results

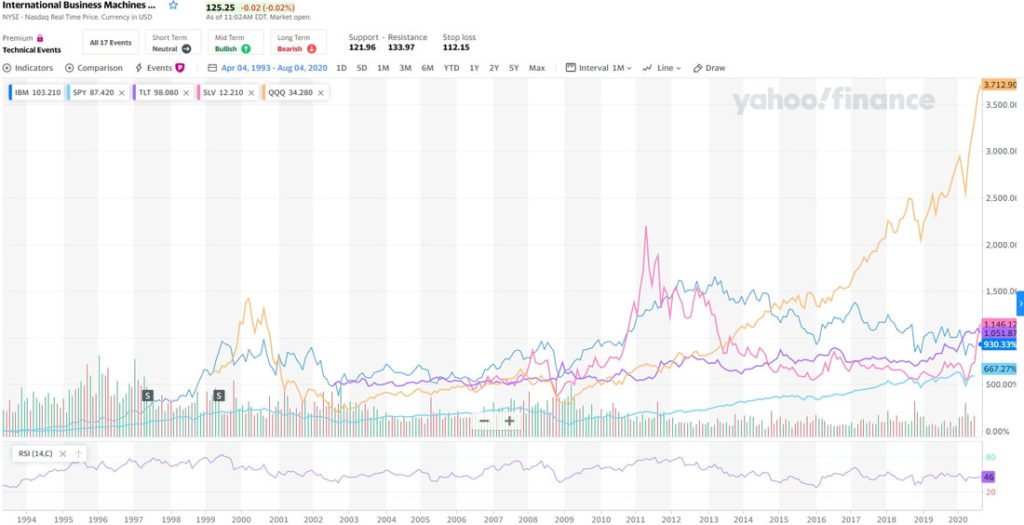

Although IBM did improve its performance from 1993 – 2000, the results at least compared to the QQQ and TLT don’t look as impressive. So, several questions remain:

References:

https://www.newsweek.com/can-he-make-elephant-dance-191732

Chart via Yahoo Finance